Investing your hard-earned money can be exciting, but it can also be nerve-wracking. With countless investment opportunities popping up online every day, it’s easy to feel like you might be missing out.

Unfortunately, not every opportunity is legitimate. Scams are rampant, and they’re designed to lure even the savviest investors into losing money.

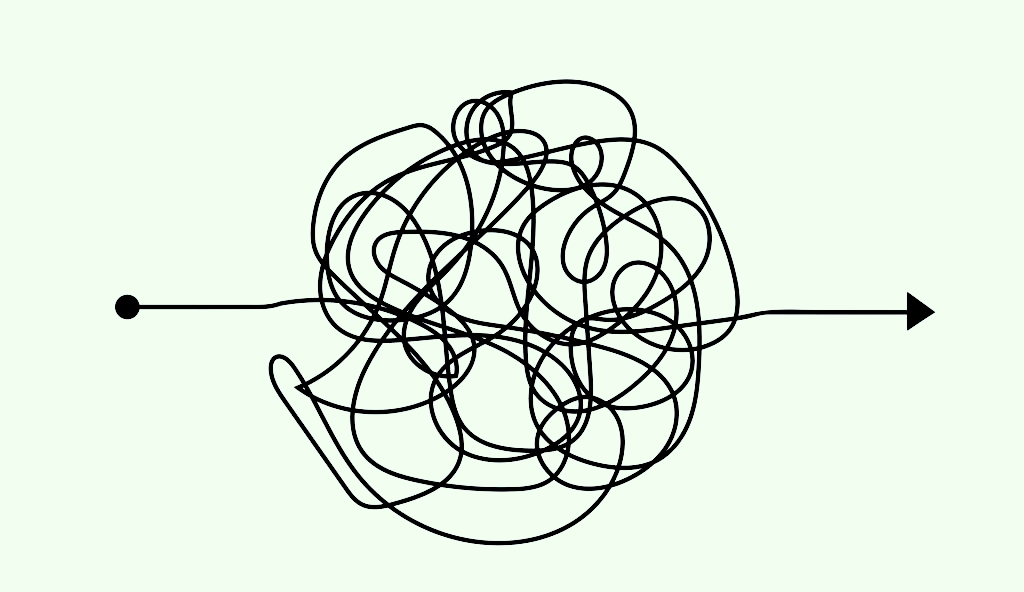

But don’t worry, you don’t need to fall prey. By learning to recognize the key warning signs, you can protect yourself and invest confidently. In this post, we’ll walk you through five red flags that indicate an investment could be a scam, plus practical tips to stay safe.

Table of Contents

Toggle1. Promises of Guaranteed or Unrealistic Returns

One of the quickest ways to identify a potential investment scam is when someone promises guaranteed returns or unusually high profits with little to no risk.

Understand The Typical Market Returns

All investments come with inherent risk. Stocks, bonds, mutual funds, and even real estate can fluctuate in value. Historically, the stock market averages around 7–10% annual return over the long term.

Anything promising returns far above that, 20%, 50%, or even 100% in weeks or months, should immediately raise red flags.

True investing requires patience, strategy, and an understanding that losses are part of the process. Also remember that if it sounds to good to be true, it probably is.

How Scammers Manipulate Expectations

Fraudsters often prey on greed and the desire for quick wealth. Common tactics include:

- “Double your money in 30 days!” – Suggests extraordinary gains without effort.

- “Guaranteed returns with zero risk!” – Ignores the fact that all investments carry risk.

- “This is an exclusive opportunity, limited spots only.” – Creates false urgency to pressure quick decisions.

These tactics exploit emotions, pushing people to act before thinking critically. Remember: if it sounds too good to be true, it probably is.

Legitimate investments never guarantee massive profits, and every sound opportunity involves some level of risk. Being skeptical of over-the-top promises is your first defense against scams.

2. Pressure to Act Fast or “Limited-Time Offers”

Scammers know that urgency works. They rely on psychological pressure to push you into making snap decisions before you have a chance to think critically or do proper research.

High-Pressure Tactics Explained

Some of the most common urgency tactics include:

- “This offer closes tonight, don’t miss out!” – Implies you’ll lose the opportunity if you hesitate.

- “Only 10 spots left, and they’re going fast!” – Creates artificial scarcity to trigger quick action.

- “Invest now or you’ll never get this opportunity again!” – Plays on fear of missing out (FOMO) and exclusivity.

These statements are carefully crafted to bypass rational thinking and push you to act emotionally.

The goal is to make you commit before asking questions, reading the fine print, or verifying the legitimacy of the offer.

Why Urgency is a Classic Scam Tactic

Legitimate investments rarely require instant decisions. Reputable opportunities allow you time to:

- Conduct due diligence

- Research the company or investment thoroughly

- Consult with a certified financial advisor or trusted mentor

If someone is pressuring you to act immediately, that’s a major red flag. Take a step back, breathe, and remember: no credible investment will punish you for taking time to think. A pause is often the best defense against falling into a scam.

3. Lack of Transparency or Vague Details

If you can’t clearly understand how an investment works, treat it as a serious warning. Scammers intentionally make information confusing or incomplete to distract you from the risks and hide potential fraud.

No Clear Business Model or Strategy

Before investing, ask yourself key questions:

- “How exactly does this investment generate returns?”

- “Who is managing the money?”

- “Where is the company registered, and is it regulated?”

If the answers are vague, inconsistent, or evasive, that’s a strong red flag. Transparency is a hallmark of legitimate investments.

Avoiding Questions and Hiding Information

Legitimate investment platforms are upfront about:

- Fees and commissions

- Potential risks and expected returns

- How your money is managed and where it goes

Red flags include:

- Refusal to provide official documentation, contracts, or prospectuses

- No verifiable team members or company information

- Excessive jargon, technical terms, or buzzwords that don’t clearly explain the process

Remember: complexity is not the same as sophistication. Scammers often hide behind complicated language to make the investment seem impressive.

If you feel confused or can’t get clear answers, step back and do more research before committing any money. Transparency is your best defense.

ALSO READ: Saving vs. Investing: What to Do With Your Next $500

4. Unregistered or Unverified Platforms/Individuals

Many scams operate through fake websites, unlicensed brokers, or individuals pretending to be financial advisors. Verifying credentials before sending money is essential to protect yourself.

How to Check Licenses and Registrations

Before investing, confirm that the platform or advisor is legitimate:

- Check financial regulatory bodies in your country (for example, the SEC in the U.S., the FCA in the U.K., or equivalent authorities elsewhere).

- Verify that the broker or investment platform is properly registered.

- Confirm that any investment advisor has the required licenses and certifications.

Red Flags in Websites, Brokers, and Social Media

Be cautious if you notice:

- No physical address, phone number, or verifiable contact information.

- Amateurish website design with typos, broken links, or inconsistent branding.

- Social media accounts with little activity, suspicious follower engagement, or stock images used for profiles.

- Testimonials that appear generic, overly glowing, or potentially fabricated.

Even a quick background check or search for reviews and regulatory records can save you from losing thousands to unverified platforms.

If something feels off or you can’t verify the legitimacy, don’t invest, your caution is your best defense.

5. Overly Complicated or Secretive Processes

Scammers often try to confuse potential investors with overly technical jargon, convoluted explanations, or secretive procedures. If you can’t understand how your money is being handled, it’s a major warning sign.

When Complexity Hides Fraud

Legitimate investments can be complex, but a trustworthy advisor or platform should always be able to explain the basics in clear, simple terms. If you’re asked to:

- Sign contracts full of confusing legalese without explanation

- Keep details “confidential” or secret

- Rely on mystery or gimmicks to justify the process

…then it’s likely a red flag. Scammers often use complexity to intimidate, distract, or prevent you from asking questions.

What Are The Legitimate Investment Structures

Common investments like stocks, ETFs, mutual funds, and real estate investment trusts (REITs) all have straightforward explanations:

- You should be able to clearly answer, “How does my money grow?”

- You should know the risks involved and the expected returns

- The process shouldn’t rely on secrecy or pressure

If the investment seems intentionally convoluted, or if explanations feel evasive, it’s often a tactic to trick you. Remember: the more you understand, the safer your money will be.

How to Protect Yourself from Scam Investments

Knowing the red flags is just the first step. Protecting your money requires proactive action. Here’s how to stay safe:

Conduct Due Diligence

Before investing, research everything you can about the company, its founders, and the investment strategy. Check:

- Independent reviews and testimonials outside the company’s website

- News coverage or press mentions

- Regulatory filings or registrations with financial authorities

Thorough research helps you separate legitimate opportunities from scams.

Use Trusted Financial Advisors

If you’re unsure about an investment, consult a licensed financial advisor. Advisors can:

- Help evaluate risk and potential returns

- Verify claims and documentation

- Provide a second opinion that may prevent costly mistakes

Verify Testimonials and Reviews

Scammers often use fake or overly positive testimonials to lure investors. To verify:

- Look for real names and verifiable results

- Check multiple sources and independent reviews

- Be skeptical of generic praise with no specifics

Start Small

Never put a large sum into a new or unverified investment. Test the waters with a minimal amount first. This limits risk while allowing you to assess legitimacy and process reliability.

Listen to Your Instincts

Trust your gut. If something feels off, overly complex, or too good to be true, step back and investigate.

Excitement, greed, or pressure tactics are common tools scammers use, don’t let them override caution.

Keep records of all communications, agreements, and receipts. In case something goes wrong, documentation can help you report fraud or recover funds.

Conclusion

Investment scams are everywhere, but being aware of the warning signs gives you the upper hand. Remember these key takeaways:

- If it promises guaranteed or unrealistic returns, it’s likely a scam.

- High-pressure tactics are a warning to pause.

- Transparency matters, avoid vague or evasive opportunities.

- Verify registration and credentials.

- Complex, secretive processes are often designed to deceive.

By spotting these red flags early, you protect your hard-earned money and build a solid foundation for real, legitimate wealth creation. Invest smart, stay cautious, and always do your homework before handing over your money.