Money isn’t just numbers in a bank account, it’s deeply tied to the way we think. Your mindset can either make saving and investing effortless or make it feel like a constant struggle.

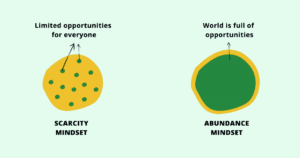

If you’ve ever wondered why some people seem to grow wealth while others can’t seem to get ahead, it often comes down to scarcity vs. abundance thinking.

Let’s explore the psychology behind money, how scarcity can hold you back, how an abundance mindset can accelerate your wealth, and practical ways to rewire your brain so you can save and invest without stress.

Table of Contents

ToggleWhy Mindset Matters for Your Money

Your brain is hardwired to respond to patterns and emotions, and money is one of the strongest emotional triggers. It can spark fear, guilt, excitement, or desire all of which strongly influence financial decisions.

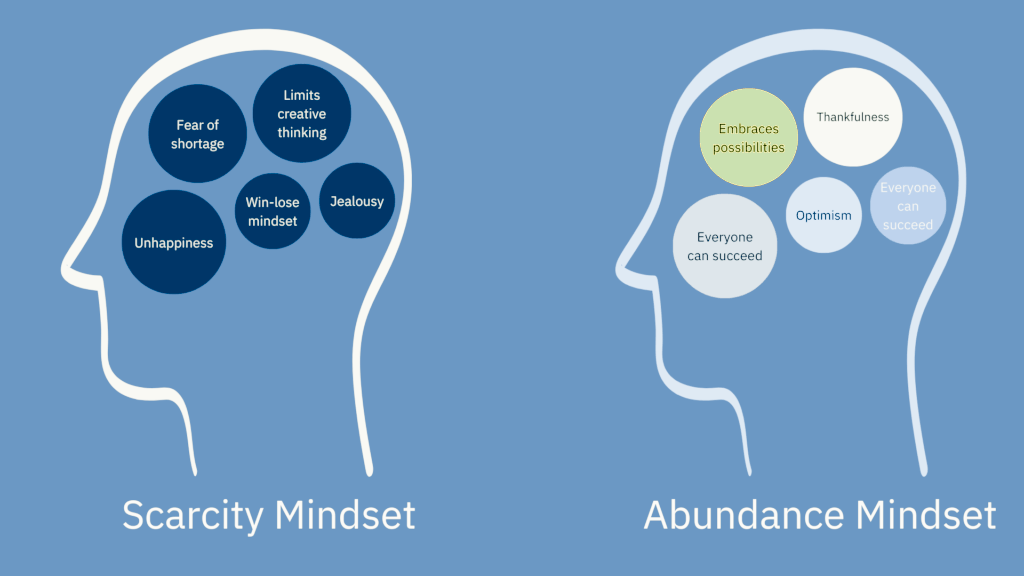

- Scarcity mindset: This mindset focuses on what’s missing. You might hoard cash, panic over small expenses, or constantly worry about running out of money. Every decision feels high-stakes, which can lead to missed opportunities.

- Abundance mindset: This mindset focuses on possibilities and growth. You plan, invest, and make your money work for you, rather than stressing over every dollar. You’re open to opportunities, willing to take calculated risks, and think long-term about wealth creation.

The good news? Your financial mindset isn’t fixed. With awareness and practice, you can train your brain to think in terms of abundance, which naturally makes saving, investing, and wealth-building easier and more consistent.

Understanding the Scarcity Mindset

A scarcity mindset is the belief that there’s never enough whether it’s money, time, or resources. It often develops from childhood experiences, financial struggles, or traumatic money events.

Signs of a scarcity mindset include:

- Constant fear of spending money, even on essentials, leading to stress and missed opportunities.

- Impulsive decisions driven by “limited time” or “limited resources” thinking, such as snapping up low-quality deals out of fear of missing out.

- Feeling guilty or anxious about money, even after responsible spending.

- Avoiding investments because of fear of loss or discomfort with uncertainty.

Why it Limits Wealth-building

Scarcity thinking keeps your focus on what you don’t have, rather than on growing what you do. Saving feels like deprivation, investing feels risky, and opportunities pass by unnoticed.

Over time, this mindset can reinforce cycles of financial stress, stagnation, and fear-driven decisions.

Shifting your mindset toward abundance doesn’t mean ignoring risk, it means acknowledging them while also seeing potential growth. This shift allows you to make smarter, calmer, and more strategic decisions with your money.

The Power of an Abundance Mindset

An abundance mindset transforms the way you think about money. Instead of fixating on what’s lacking, you focus on opportunities, growth, and potential.

This shift in perspective can dramatically improve both your financial decisions and your overall well-being.

Benefits of an Abundance Mindset:

- Smart decision-making: You’re more willing to invest, start side hustles, or explore passive income opportunities because you focus on potential returns rather than fearing loss.

- Resilience: Setbacks are viewed as temporary challenges, not financial catastrophes. This mindset encourages problem-solving rather than panic.

- Openness to opportunities: You become more aware of new income streams, investment options, and creative ways to grow wealth.

- Consistent growth: Operating from possibility rather than limitation allows even small investments or efforts to compound faster, as you consistently make confident, strategic decisions.

Think of it like planting seeds in fertile soil. With an abundance mindset, you’re more likely to water them, nurture them, and explore new patches of land.

Your money, skills, and opportunities all grow faster when approached with optimism and strategy.

ALSO READ: How to Save Money Without Tracking a Single Expense

Scarcity vs. Abundance: How They Shape Your Financial Behavior

Your mindset has a direct impact on your financial habits and outcomes. Here’s how each perspective plays out:

- Spending habits: Scarcity thinking encourages hoarding and frugality to the point of stress, while an abundance mindset promotes smart, intentional spending that balances saving and investing.

- Risk-taking: Scarcity makes you overly cautious, leading to missed opportunities for wealth-building. Abundance allows calculated risks, such as investing in stocks, starting a business, or exploring new income streams.

- Long-term planning: Scarcity keeps you focused on short-term survival and immediate needs. Abundance encourages planning for the future, including passive income strategies, investments, and financial independence.

In essence, abundance thinking creates a feedback loop: your mindset shapes your habits, your habits grow your wealth, and growing wealth reinforces your positive mindset.

By consciously adopting abundance principles, you set yourself up for smarter financial decisions and long-term prosperity.

Rewiring Your Brain for Abundance

Your financial mindset isn’t fixed, your brain can be trained to think in terms of abundance with consistent, intentional practice.

By reinforcing positive patterns, you can shift your focus from fear and limitation to growth and opportunity.

Daily Exercises:

- Celebrate small wins: Each day, write down three financial successes, no matter how small, like saving $20, paying off a bill, or finding a better deal. Over time, this shifts your attention from scarcity to progress.

- Affirmations for growth: Repeat statements such as “I have the power to grow my wealth” or “Money flows to me easily.” Affirmations train your subconscious to recognize opportunity instead of fear.

Journaling and Visualization:

- Visualize your ideal financial future: Picture the security, freedom, and lifestyle you want. Imagine how it feels to make confident financial decisions and watch your money grow.

- Track your progress: Document milestones, savings, and investment growth. Seeing tangible results reinforces an abundance-oriented mindset.

Overcoming Limiting Beliefs:

- Identify negative thoughts like “I’ll never have enough” or “Money is hard to get.”

- Consciously replace them with positive, abundance-focused thoughts such as “I can create opportunities to grow wealth” or “Every day, I make smarter financial choices.”

- Over time, these repeated mental shifts rewire your brain, helping you approach money with confidence rather than fear.

Practical Strategies to Save Effortlessly

An abundance mindset doesn’t mean ignoring reality, it means building systems that make wealth growth natural and stress-free.

- Automate your savings: Set up automatic transfers to savings accounts, retirement funds, or investment portfolios. This removes reliance on willpower and ensures consistent progress.

- Prioritize expenses: Clearly separate needs from wants. You can still enjoy life while maintaining healthy savings habits.

- Leverage AI and apps: Tools like YNAB, Mint, Plum, or even robo-advisors can track spending, suggest optimizations, and automate investments, keeping your finances on autopilot.

Even small, consistent action compounded over time, lead to effortless financial growth. By combining mindset exercises with practical automation, you create a feedback loop: the more you focus on abundance, the easier it becomes to save, invest, and build wealth without stress.

ALSO READ: How to Save Like a Millionaire: 9 Habits Wealthy People Use That You Can Too

Investing With an Abundance Mindset

An abundance mindset changes not just how you think about money, but how you approach investing. By focusing on growth and opportunity rather than fear, you can make smarter, more strategic financial decisions.

- Diversify intelligently: Rather than putting all your money in one investment, spread it across stocks, ETFs, mutual funds, or digital assets like cryptocurrencies. Diversification reduces risk while increasing your chances of consistent returns.

- Think long-term: Abundance-minded investors prioritize compounding over years rather than chasing short-term gains. Even small, consistent investments can grow substantially over time.

- Avoid fear-based decisions: Scarcity triggers panic selling during market dips, often locking in losses. An abundance mindset encourages patience, letting your investments weather volatility and grow steadily.

- Start small, grow steadily: Even if your income is limited, consistent micro-investments paired with long-term thinking can evolve into meaningful wealth over time.

By viewing investing as a tool to create opportunity rather than a source of stress, you naturally make decisions that compound both financial and personal growth.

Combining Scarcity Awareness with Abundance Action

Awareness of scarcity doesn’t have to be limiting, it can be a powerful motivator when paired with abundance-oriented strategies:

- Use scarcity as motivation: Tight finances can inspire smarter budgeting, careful planning, and more disciplined spending.

- Budget with abundance: Allocate funds not only for essentials but also for savings, investments, and small pleasures. This balance keeps your mindset positive while staying practical.

- Track your progress: Celebrate milestones, no matter how small like reaching a savings goal, hitting an investment target, or reducing debt. Recognizing progress reinforces positive financial habits and strengthens your abundance mindset.

This dual approach keeps you grounded in reality while fostering optimism. By combining practical financial management with a growth-focused mindset, you create a system where your money works for you, rather than being a source of stress.

Conclusion: Living a Financially Abundant Life

Shifting from scarcity to abundance isn’t instantit’s a gradual process.

Key takeaways:

- Your mindset drives financial behavior. Change your thinking, change your results.

- Combine mental rewiring with practical tools like automation, AI apps, and smart investments.

- Focus on small wins and consistent growth. Over time, this compounds into effortless saving and investing.

By embracing abundance, you can enjoy financial freedom without stress. You’ll save smarter, invest confidently, and finally stop living paycheck to paycheck.

Start today: Reframe your thoughts, automate your finances, and make small, consistent investments. The brain trained in abundance will make your money work for you effortlessly.